What is a retention bonus?

A retention bonus is a financial incentive, usually paid out as a lump sum, offered by an employer to a valuable employee to encourage them to stay with the company for a specified period of time. This type of bonus is typically used when the continuity of the employee’s service is considered crucial to the organization’s success or stability.

Employee retention bonuses are common during mergers, acquisitions, periods of significant change or transformation within the company, or when there is a high demand for skilled workers in the job market, making it easy for employees to find alternative employment.

What is an average retention bonus?

A retention bonus amount may vary from a modest sum to a significant percentage of an employee’s yearly salary, often between 10% and 25% of their base pay. However, in industries that highly value specialized skills or in situations where an employee’s exit would cause significant disruption, the bonus could exceed these percentages.

Retention bonus examples

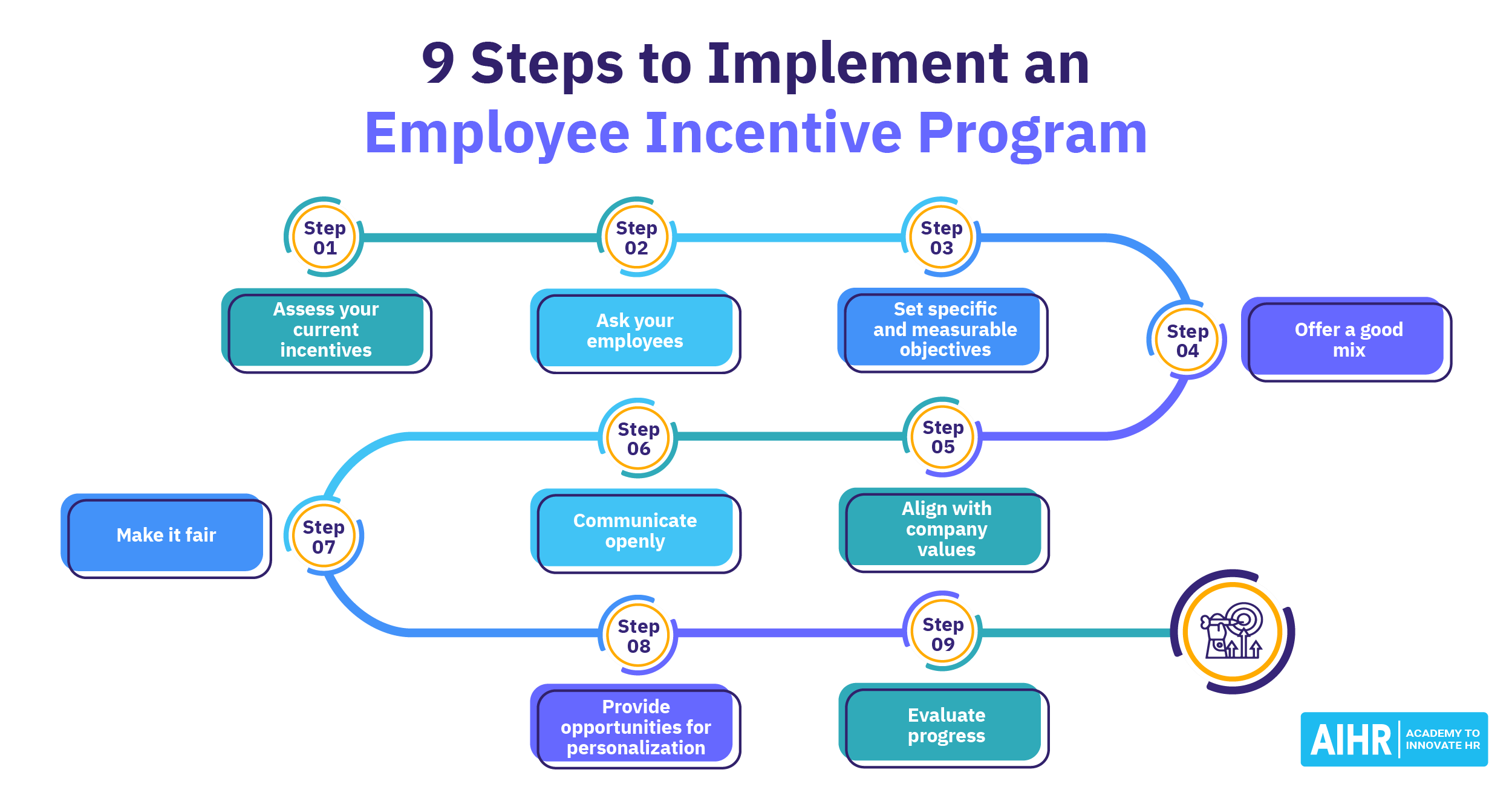

There are several ways retention bonuses can be issued. Below are some common types and how they might be applied:

- Tech industry – Senior Software Engineer: A fast-growing startup might offer a $50,000 bonus to a senior engineer paid in two installments: $25,000 after 12 months and the remaining $25,000 at the end of 24 months. If the employee leaves early, they forfeit the unpaid portion.

- Healthcare – ICU Nurse: A hospital facing staff shortages could provide a $10,000 retention bonus to ICU nurses who commit to a 2-year term. The bonus might be prorated if they leave before the term ends.

- Finance – Compliance Officer: To navigate a merger, a bank might offer a $30,000 bonus to compliance officers to stay until the integration completes, typically 18 months. The full amount is paid at the end if they remain.

- Retail – Store Manager: A national retailer might offer a $5,000 retention bonus to store managers in high-turnover locations to stay for a full fiscal year. Some companies split the bonus into quarterly payouts to maintain regular incentives.

- Manufacturing – Plant Supervisor: During a production ramp-up, a manufacturing company might offer a $15,000 bonus to key supervisors who commit to staying for 12 months. The bonus is paid in full at the end of the term.

- Corporate Leadership – CFO: As part of an executive contract during an acquisition, a CFO could receive a $250,000 bonus to remain until the deal closes and post-transition plans are completed, typically a 2-year span.

Design retention strategies that protect your talent

Retention bonuses can help you keep critical employees on board—but only if they’re well-structured, compliant, and aligned with business needs.

In AIHR’s Compensation & Benefits Certificate Program, you’ll learn how to design smart incentive plans, structure bonus agreements, and apply best practices that support retention while managing cost and risk.

Retention bonus tax rate

In the United States, retention bonuses are taxable as supplemental pay under IRS rules, subject to federal income tax, Social Security, and Medicare taxes. The IRS allows two primary methods for withholding taxes on this type of compensation:

- Percentage method: With this method, bonuses are separated from the employee’s salary and taxed directly at a flat rate of 22%. However, a bonus exceeding $1 million is subject to a higher taxation rate of 37%, corresponding to the maximum income tax rate applicable for the given year.

- Aggregate method: Here, the bonus is combined with the employee’s usual salary into a single payment for the purpose of tax withholding. The withholding table determines the applicable tax rate, referencing the data provided on the employee’s IRS W-4 Form.

Stay bonus vs. retention bonus

Here’s a quick comparison to clarify the differences between a stay bonus and a retention bonus:

Purpose

Offered during a specific event or transition (e.g., merger, project closeout)

Aims to keep employees long-term, beyond specific events

Duration

Typically short-term (a few months to a year)

Often tied to a longer commitment (1–3 years or more)

Common use cases

Mergers, acquisitions, restructuring, key project completion

High turnover roles, hard-to-fill positions, succession planning

Target audience

Usually key personnel critical during change or uncertainty

Broader group of valuable employees the company wants to retain

Tax treatment

Both are treated as supplemental income under IRS rules and taxed accordingly

Same as stay bonus, subject to federal, Social Security, and Medicare taxes

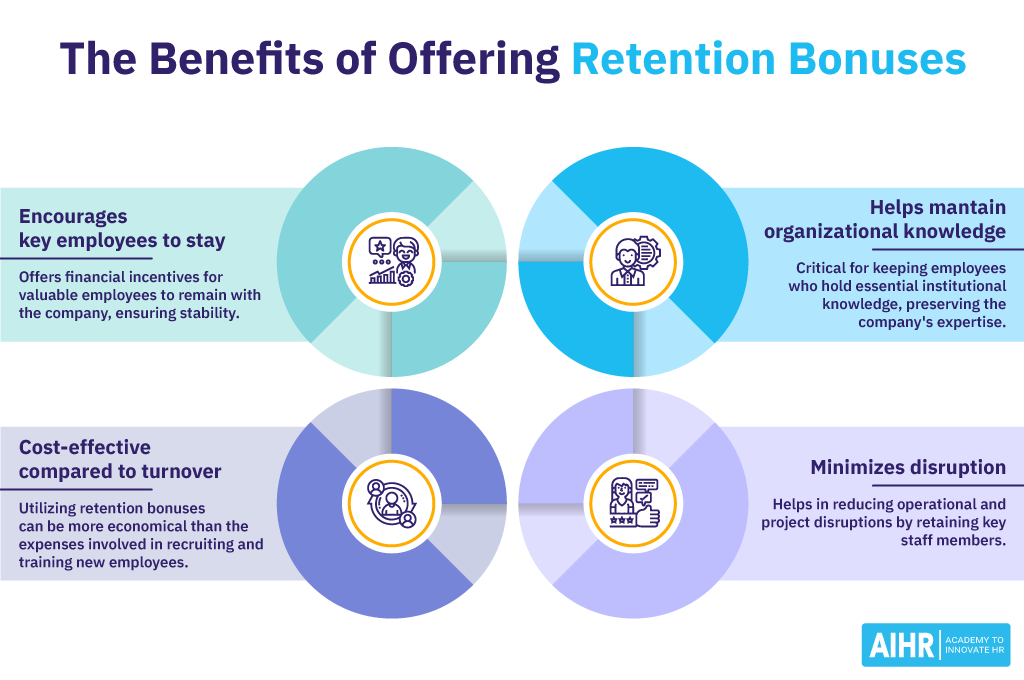

Benefits of offering retention bonuses

Offering retention incentive bonuses can be a strategic tool for companies aiming to maintain a stable and experienced workforce. Here are some of its benefits:

- It encourages key employees to stay: They provide a financial incentive for valuable employees to remain with the company for a specified period.

- It helps maintain organizational knowledge: They are crucial in incentivizing employees to remain with the company, preserving the invaluable institutional knowledge and expertise they have accumulated over time.

- It minimizes disruption: By encouraging key employees to stay, companies can reduce disruptions to their operations and ongoing projects.

- It’s cost-effective compared to turnover: The cost of hiring and training new employees can be significantly higher than retaining existing ones. Retention bonuses can be a cost-effective strategy to maintain institutional knowledge and reduce the costs associated with turnover.

What HR should include in a retention bonus agreement?

Here’s what HR should typically include in a retention bonus agreement to ensure clarity, fairness, and legal compliance:

- Qualification requirements: Determine who is eligible for the bonus. Criteria may include job function, level of seniority, specific skills, or contribution to critical projects.

- The bonus details: Decide on the bonus amount and whether it will be a flat rate, a percentage of the employee’s salary, or based on other factors such as performance metrics.

- Timing of payment: Common approaches include lump-sum payments after a certain service period, phased payments at key milestones, or a final payment upon project or transition period completion.

- Clawback provisions: Outline specific conditions under which the bonus must be repaid to the company. These conditions might include voluntary resignation or termination for cause before a specified period.

- Tax implications: Consult with legal and financial experts to understand the retention bonus’s legal and tax implications for both the organization and the employees.

HR tip

Regularly review and adjust retention bonuses to reflect current market trends and the evolving needs of your workforce. This proactive approach ensures your strategy remains competitive and relevant, effectively retaining key talent in a dynamic employment landscape.

FAQ

A retention bonus is a one-time payment offered to encourage an employee to stay with a company for a set period. It’s typically paid out after the employee fulfills the agreed-upon term, often outlined in a written agreement.

A retention bonus is typically paid out at a predetermined time specified in the retention agreement, which is after the employee has fulfilled the required condition of staying with the company for a certain period.

No, a retention bonus is usually a one-time payment tied to a specific length of service, not an annual benefit. If the employee stays with the company, it’s paid at the end of the agreed-upon period.