A Payroll Administrator is central to smooth operations and employee trust. Global employee engagement fell from 23% to 21% last year, costing the economy an estimated $438 billion in lost productivity. Payroll accuracy and trust are also directly linked — in fact, 49% of employees would job-hunt after two incorrect pay cycles.

Handling ayroll is about more than numbers — it’s about trust, consistency, and a smooth employee experience. Payroll Administrators ensure accuracy, compliance, and efficiency across HR and finance, strengthening both legal integrity and employee confidence.

Contents

What is a Payroll Administrator?

Payroll Administrator job description

Qualifications for a Payroll Administrator role

Skills and competencies for a Payroll Administrator role

AIHR certificate programs to take

Career paths for a Payroll Administrator

What is a Payroll Administrator?

A Payroll Administrator ensures employees are paid accurately and on time. This includes calculating wages, overtime, bonuses, deductions, and benefits while managing tax withholdings, retirement contributions, and compliance with labor laws.

They link HR, finance, and employees by resolving payroll queries, maintaining records, and supporting audits. They also manage payroll software, generate reports, and stay updated on tax rules. Precision, confidentiality, and knowledge of employment law are critical to avoid trust issues and costly compliance failures.

Payroll Administrator job description

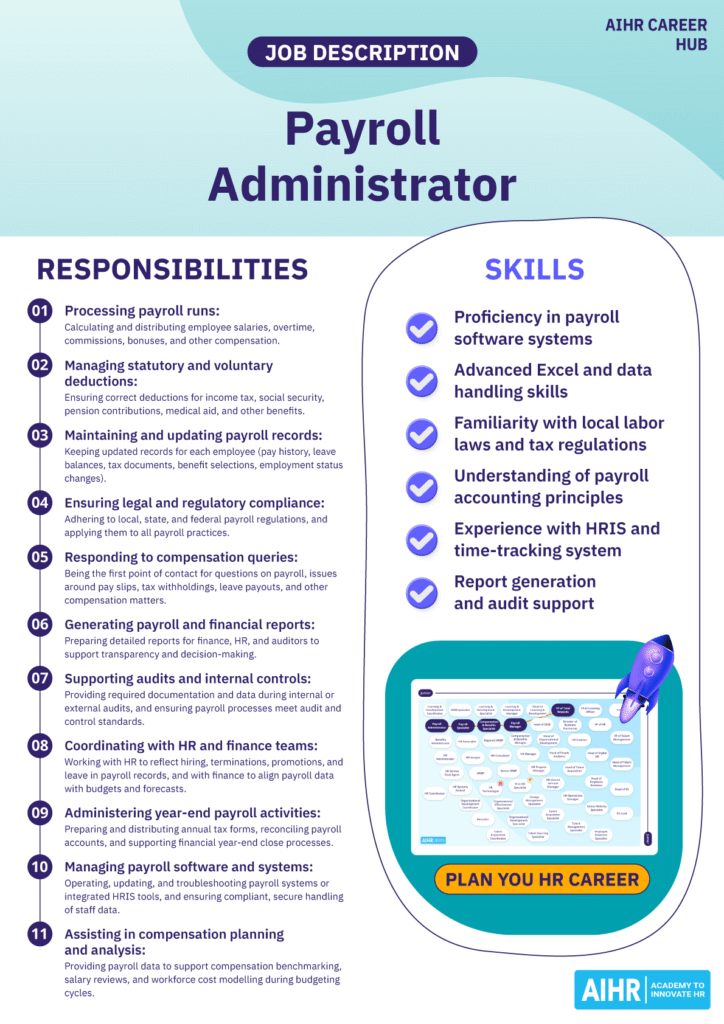

In addition to ensuring smooth, compliant payroll operations, the Payroll Administrator role directly impacts retention, morale, and employer reputation. Key responsibilities include:

- Process payroll runs: Calculate and distribute salaries, overtime, commissions, bonuses, and other pay accurately and on schedule.

- Manage deductions: Apply correct deductions for taxes, social security, pensions, medical aid, benefits, direct deposits, and garnishments.

- Maintain payroll records: Keep updated pay history, leave balances, tax documents, benefits, and employment changes.

- Ensure compliance: Follow all local, state, and federal payroll regulations to avoid penalties.

- Resolve employee queries: Handle questions about payslips, tax withholdings, leave payouts, and other pay issues.

- Generate reports: Prepare payroll summaries, tax filings, and reconciliations for finance, HR, and auditors.

- Support audits: Provide documentation and ensure payroll meets audit and control standards.

- Coordinate with HR and finance: Update payroll for new hires, terminations, promotions, and leave, and align with budgets and forecasts.

- Manage year-end payroll: Issue annual tax forms, reconcile payroll accounts, and assist with year-end close.

- Oversee payroll systems: Operate, update, and troubleshoot payroll software while protecting employee data.

- Assist in compensation planning: Provide payroll data for benchmarking, salary reviews, and workforce cost analysis.

Qualifications for a Payroll Administrator role

To succeed as a Payroll Administrator, candidates need a combination of education, technical knowledge, and practical experience. Though there are entry-level opportunities for this position, employers usually prefer candidates with a strong foundation in payroll systems, accounting principles, and compliance frameworks.

Educational requirements

A high school diploma or GED is the minimum educational requirement for most Payroll Administrator roles. Strong numeracy, communication, and organizational skills, typically developed during high school education, can form the foundation for success in this position.

Some employers may prefer candidates with an associate’s or bachelor’s degree in accounting, business administration, or HR. A formal qualification in a related field helps build essential knowledge of financial systems, labor laws, and HR operations. It may also improve job prospects, particularly in larger organizations or specialized industries.

Recommended certifications (optional but highly valued)

Professional certifications signal specialized knowledge, and can boost credibility and open doors to more senior roles. One example is the Fundamental Payroll Certification (FPC), which the American Payroll Association (APA) offers. It’s ideal for entry-level professionals or those supporting payroll teams, and covers core payroll concepts, compliance basics, and processing fundamentals.

The APA also offers the Certified Payroll Professional (CPP) certification for experienced practitioners. It demonstrates advanced knowledge of payroll operations, tax regulations, benefits, and internal controls. Senior-level or management payroll positions often require this certification.

Experience requirements

For entry-level roles, one to two years in an administrative, accounting support, or HR Assistant role may be sufficient to begin a payroll career. Employers typically look for familiarity with data entry, spreadsheets, and basic reporting.

For mid-level to senior roles (especially in large or multinational organizations), employers may prefer candidates with three to five years of hands-on payroll experience. Experience with payroll software systems (e.g., ADP, Paycom, Sage, Xero), knowledge of multi-jurisdictional tax law, and exposure to audits or compliance reporting are often required.

Learn how to set up and run an effective payroll process

To ensure payroll is accurate, timely, compliant, and integrated with other HR processes, you must maintain up-to-date regulatory knowledge, and foster close collaboration between payroll, HR, and finance.

✅ Understand the payroll approaches that influence your payroll process

✅ Learn how to create an efficient payroll schedule for your organization

✅ Use real-life examples and case studies to prepare for payroll admin challenges

✅ Obtain skills valuable for advancing to senior payroll or HR roles

Learn at your own pace with the online HR Generalist Certificate Program.

Skills and competencies for a Payroll Administrator role

To succeed in a payroll administrator role, candidates need a balanced mix of technical proficiency and interpersonal effectiveness. This includes the following skills and competencies:

Technical skills

- Payroll software proficiency: You’ll need experience with tools like ADP, Paychex, or Xero to handle data entry, troubleshoot issues, generate reports, and configure settings correctly.

- Advanced Excel skills: Proficiency in functions like VLOOKUP, pivot tables, conditional formatting, and data reconciliation can help you manage timesheets, and tax reports.

- Knowledge of labor and tax laws: A Payroll Administrator must have a solid understanding of statutory deductions, overtime rules, minimum wage changes, and filing requirements to avoid compliance issues.

- Payroll accounting knowledge: As a Payroll Administrator, you need to be familiar with debits, credits, accruals, and payroll journal entries. This will enable you to support accurate financial reporting and reconciliation.

- HRIS and time-tracking systems: Experience with Kronos, BambooHR, or Oracle HCM can help you coordinate employee data, leave, and benefits.

- Report generation and audit support: The ability to extract, interpret, and prepare payroll data for finance, HR, auditors, and tax filings is crucial for a Payroll Administrator.

Soft skills

- Attention to detail: This skill can help ensure accuracy in data entry, reconciliation, and document handling to avoid payroll errors and compliance risks.

- Confidentiality: As a Payroll Administrator, you must be discreet in handling sensitive personal and financial information. This helps you maintain compliance with privacy laws and ethical standards.

- Communication skills: Payroll Administrators must be able to clearly explain payslips, resolve discrepancies promptly and accurately, and collaborate with HR, finance, and external partners efficiently.

- Problem-solving and time management: These skills are crucial to help you diagnose and resolve payroll issues quickly, prioritize tasks, and meet strict payroll deadlines — especially during high-volume periods.

- Adaptability: This skill will ensure Payroll Administrators stay updated on tax, technology, and business changes, and can learn new systems as needed.

- Customer service mindset: While Payroll Administrators don’t have external customers, they must still provide patient, solutions-focused support to employees to reinforce trust in payroll.

HR tip

If you want to stand out in your payroll career, go beyond mastering the mechanics and question the status quo. Ask why specific deductions apply, or how payroll data supports workforce planning or financial forecasting? The more you understand how payroll fits into the broader business strategy, the more valuable you become. This shift from task execution to business contribution sets the foundation for leadership roles.

Average Payroll Administrator salary

The average gross annual salary for a Payroll Administrator in the U.S. is $61,109. An entry-level Payroll Administrator (with one to three years of experience) earns an average yearly salary of US$44,822. In comparison, a Senior Payroll Administrator (with eight or more years of experience) earns an average annual salary of $74,663.

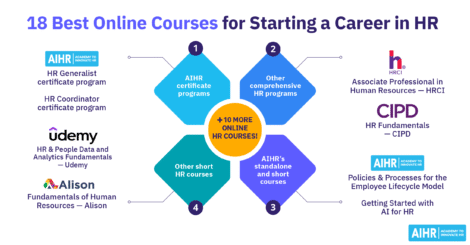

AIHR certificate programs to take

AIHR’s certificate programs help payroll professionals think beyond the pay slip. Whether you want to automate routine processes, contribute to compensation planning, or become a cross-functional HR leader, these programs bridge the gap between execution and impact.

HR Generalist Certificate Program

The HR Generalist Certificate Program includes dedicated lessons on running a successful payroll process, covering insourcing, co-sourcing, and outsourcing approaches. It also covers legal and policy requirements and how to set up a payroll schedule and calendar. The program imparts skills in HR policies, employee relations, and compliance.

Digital HR 2.0 Certificate Program

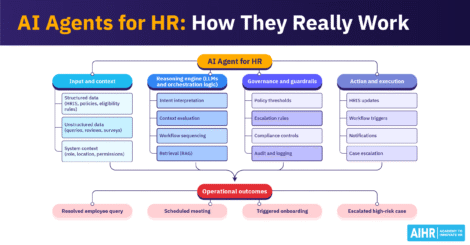

The Digital HR 2.0 Certificate Program builds digital fluency for working with HRIS platforms, payroll systems, and integrated data flows. It covers payroll software navigation, report generation, adaptability with new tools, and process optimization. It’s a deal for automating tasks and working more efficiently across digital systems.

People Analytics Certificate Program

AIHR’s People Analytics Certificate Program teaches data collection, analysis, and presentation for payroll reporting and cost analysis. You’ll also obtain advanced Excel skills and learn to work with finance and HR on workforce planning, budgeting, and compensation analytics. This helps you move beyond transactions into strategic payroll insights.

Compensation & Benefits Certificate Program

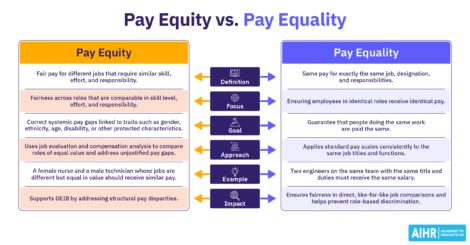

The Compensation & Benefits Certificate Program explores C&B design and structure. It also covers pay equity, tax implications, employee benefits administration, strategic alignment with total rewards, and collaboration with HR to connect payroll execution to broader compensation goals. It’s ideal for building strong foundations in pay, benefits, and compliance.

Career paths for a Payroll Administrator

Payroll Administrators can grow in multiple directions, building on core skills in compliance, financial accuracy, and employee trust. These abilities transfer easily into strategic roles, especially with continued learning and cross-functional exposure.

One option is advancing from Payroll Administrator to Payroll Specialist, Compensation & Benefits Specialist, Payroll Manager, and ultimately, VP of Total Rewards — ideal for those who enjoy operations, leadership, and shaping compensation strategy.

Another path leads into broader HR strategy, progressing to Benefits Administrator, HR Generalist, Regional HR Business Partner, or Compensation and Benefits Manager — suited to those who value employee interaction, benefits alignment, and workforce planning.

HR tip

One of the most effective career development strategies is shadowing someone in a role you aspire to. Whether it’s a Payroll Manager, HR Business Partner, or Total Rewards Analyst, learning how they make decisions, use data, and handle complexity will give you valuable real-world context. It also helps you identify the skills you’ll need to move forward.

Next steps

Whether you’re just starting out or looking to advance your payroll career, the most important step is to keep growing your skills and expanding your perspective. Take time to reflect on which career path resonates most with your strengths and interests, whether it’s leading payroll operations, contributing to HR strategy, or driving operational excellence.

Identify one or two key skills you’d like to develop next — such as payroll compliance, analytics, or benefits management — and start building them deliberately. The payroll profession is moving fast, and with the right mindset and learning approach, so can your HR career.