What are full time hours per week?

According to the IRS and the Affordable Care Act (ACA), employees are considered full-time if they work at least 30 hours per week or 130 hours per month. There’s no federal law in the U.S. that sets a standard number of hours for full time status, so it’s up to employers to define what full time means within their organization.

Typically, full-time schedules fall between 35 and 40 hours a week. The Fair Labor Standards Act (FLSA) classifies any hours worked beyond 40 in a week as overtime for nonexempt employees.

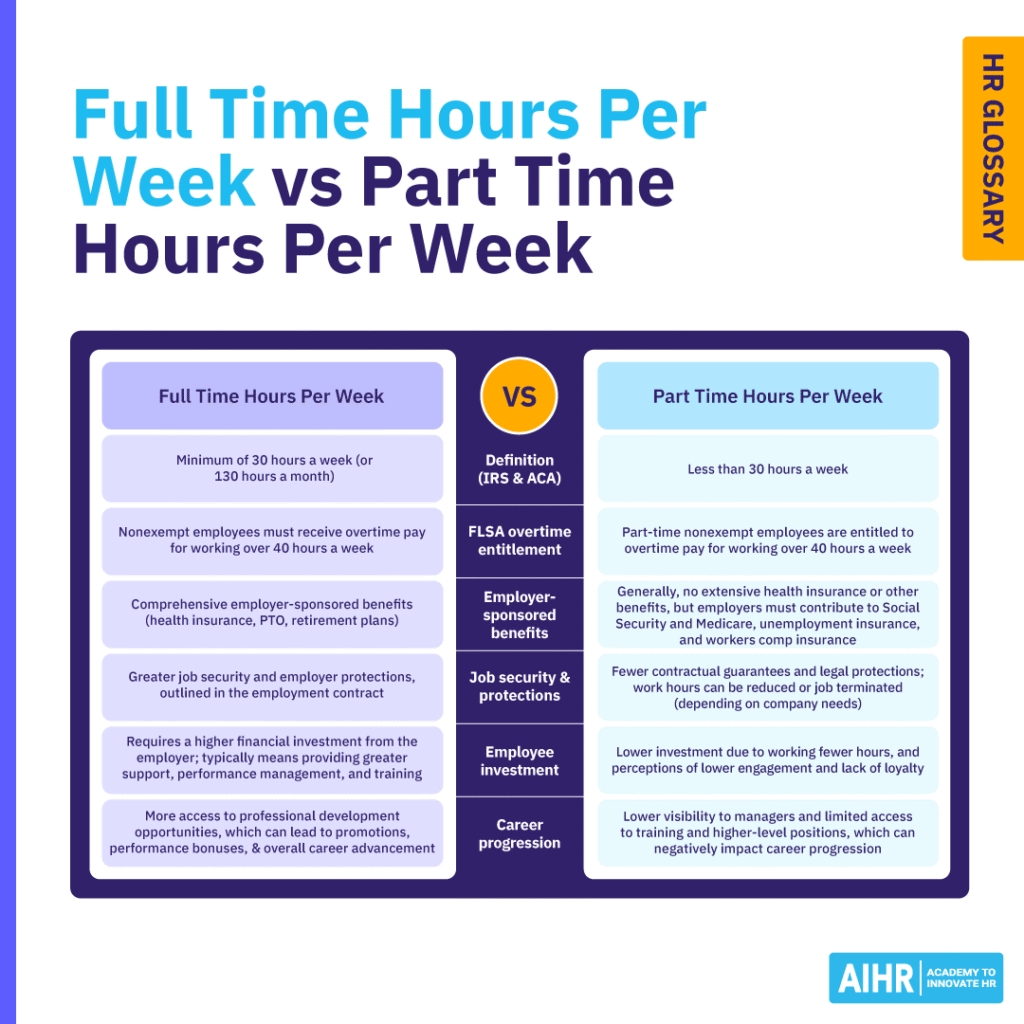

Full time vs. part time hours per week

Definition (IRS and ACA)

Minimum of 30 hours a week (or 130 hours per month).

Less than 30 hours a week.

FLSA overtime entitlement

Nonexempt employees must receive overtime pay for working over 40 hours a week.

Part-time nonexempt employees are entitled to overtime pay for working over 40 hours a week.

Employer-sponsored benefits

Comprehensive employer-sponsored benefits (health insurance, PTO, retirement plans).

Generally, no extensive health insurance or other benefits, but employers must contribute to Social Security and Medicare, unemployment insurance, and workers comp insurance.

Job security and protections

Greater job security and employer protections are outlined in the employment contract.

Fewer contractual guarantees and legal protections; work hours can be reduced or job terminated (depending on company needs).

Employee investment

Requires a higher financial investment from the employer; typically means providing greater support, performance management, and training.

Lower investment due to working fewer hours, and perceptions of lower engagement and lack of loyalty.

Career progression

More access to professional development opportunities, which can lead to promotions, performance bonuses, and overall career advancement.

Lower visibility to managers and limited access to training and higher-level positions, which can negatively impact career progression.

What benefits are linked to full time hours per week?

In the U.S., employers are only legally obligated to provide Social Security, unemployment insurance, Medicare, and family and medical leave (if they have more than 50 employees).

That said, full time employees often receive a broader range of benefits, including:

- Health insurance: Under the Affordable Care Act (ACA), companies with 50 or more full-time employees must offer health insurance. Depending on the employer, this can include medical, dental, and vision plans. The employer may partially or fully pay premiums.

- Paid time off (PTO): This typically includes vacation, sick leave, and personal days. According to company policy, the amount of PTO for full time employees can be fixed, accrued, or even unlimited.

- Retirement plans: Options like 401(k)s, IRAs, or pensions often come with employer contributions. Some states require businesses to either offer a retirement plan or enroll workers in a state-sponsored one.

- Bonuses and profit sharing: Beyond base salary, many full time workers are eligible for additional compensation such as bonuses, profit-sharing arrangements, or commissions, depending on performance.

- Professional development: Professional growth and career advancement opportunities have become a growing expectation among employees. Organizations often grant full time employees access to training to learn new skills and further their careers.

Learn to maintain compliance and fairness in C&B

Build your skills in ensuring compliance and fairness when handling compensation and benefits for different groups of employees.

AIHR’s Compensation and Benefits Certificate Program teaches you the various aspects of pay (e.g., base and variable pay), how to create a future-proof C&B strategy, and protect your organization from unnecessary risk.

- Workplace perks: Non-monetary perks such as subsidized lunches, health and wellness activities, and flexible work options are some common perks for full time employees.

- Job security and legal protections: Full time employees typically enjoy greater job security and legal protections, which are formalized in employment contracts, as well as certain state and federal laws. Examples include the right to advance termination notice, access to health insurance, and unemployment benefits.

- Family and medical leave: The Family and Medical Leave Act (FMLA) grants employees who work at least of 1,250 hours in a 12-month period (a minimum of 26 hours a week) the right to unpaid, job-protected leave for a range of circumstances, such as birth, caring for sick family members, or long-term illness.

- Life and disability insurance: Most employers provide life insurance as a benefit, offering base coverage at no or minimum cost to full time employees. In addition, employers may also partially or fully cover short- and long-term disability insurance in case of non work-related illness or injury.

- Employee assistance programs (EAPs): EAPs provide employees with confidential support, such as free assessments, counselling, and referrals. They are a voluntary benefit employees can access for help with stress, mental health, or any other personal or work-related issues.

HR tip

Encourage managers to also regular check-ins with part time employees. Discuss their career goals to identify those who may want to transition to full time hours in the future. This proactive approach not only increases engagement and retention but can also support succession planning.

Do staff who work full time hours per week earn overtime?

Not all employees who work full time hours per week earn overtime. Here is a helpful overview to explain overtime qualifications for employees working full time hours:

Job classification and labor laws

Typically, nonexempt employees (those not exempt from earning overtime) must be paid for hours worked over 40 hours per week. The minimum overtime rate is 1.5 times an employee’s regular rate (time and a half). Some employers may offer exempt employees overtime pay, “comp time”, or bonuses — even if not legally required.

Union agreements

Collective bargaining agreements (CBAs) can outline overtime stipulations for full time nonexempt employees that may differ from standard labor laws. These union agreements often have more generous terms, such as double-time rates. In some instances, overtime provisions can include exempt employees.

Working public holidays or weekends

Time worked outside of normal working hours, such as weekends and public holidays, is often paid at a premium rate (e.g., two times the regular rate) to nonexempt employees, depending on state laws or company policy. This premium rate does not necessarily cover hours worked beyond 40 hours a week.

FAQ

There’s no single legal standard in the U.S. for what counts as full-time work. However, several agencies offer definitions. The IRS and the ACA consider 30 hours per week (or 130 per month) as full-time, while the Bureau of Labor Statistics uses 35 hours per week as its benchmark.

Yes. Under the ACA, working 30 hours per week qualifies as full-time. Employers with 50 or more staff must offer health insurance to those employees.