What are ordinary time earnings (OTE)?

Ordinary Time Earnings (OTE) refer to the payments an employee receives for their ordinary work hours. This figure is used to calculate superannuation guarantee (SG) contributions under the Superannuation Guarantee (Administration) Act. OTE includes most regular earnings, such as salary, allowances, commissions, and shift loadings, but excludes overtime.

Understanding what counts as OTE is essential for HR and payroll teams. Getting it wrong can lead to underpaid super, legal issues, and administrative headaches, especially during audits.

Why are ordinary time earnings important?

Ordinary Time Earnings (OTE) are the basis for payroll and superannuation compliance in Australia. Here’s why HR professionals need to understand how it works:

Superannuation Guarantee (SG) contributions are based on OTE

OTE determines the minimum superannuation contribution employers must make for their employees. The Superannuation Guarantee requires employers to contribute a percentage of an employee’s OTE into their nominated super fund. Misunderstanding OTE can lead to underpayments, attracting penalties, interest charges, and reputational damage.

It’s key to payroll compliance

HR and payroll teams ensure wages and superannuation payments align with the law. OTE is the benchmark the Australian Taxation Office (ATO) uses to assess super contributions. If your payroll system misclassified earnings, or if certain allowances or shift loadings were excluded incorrectly, the business could fail to meet its super obligations, even if it’s paying what it believes is fair.

It promotes transparency in employee pay

When employees see their payslips and super contributions reflect their actual ordinary earnings, trust is built, and disputes are avoided. It also ensures their future retirement savings reflect their work’s true value.

It ensures consistency across employment types

Different employment arrangements (full-time, part-time, casual) can involve varying pay structures. OTE provides a consistent reference point across these types, helping HR standardize superannuation calculations and reduce confusion, especially in large or complex workforces.

It reduces audit administrative risk

If the ATO audits your organization, a well-documented approach to defining and applying OTE demonstrates due diligence. Clear internal policies and payroll processes reduce the risk of compliance breaches and costly corrections.

HR tip

Create a simple internal reference sheet tailored to your organization’s typical roles that outlines what counts and doesn’t count as OTE. This helps frontline managers avoid making informal pay promises that could lead to confusion or compliance issues.

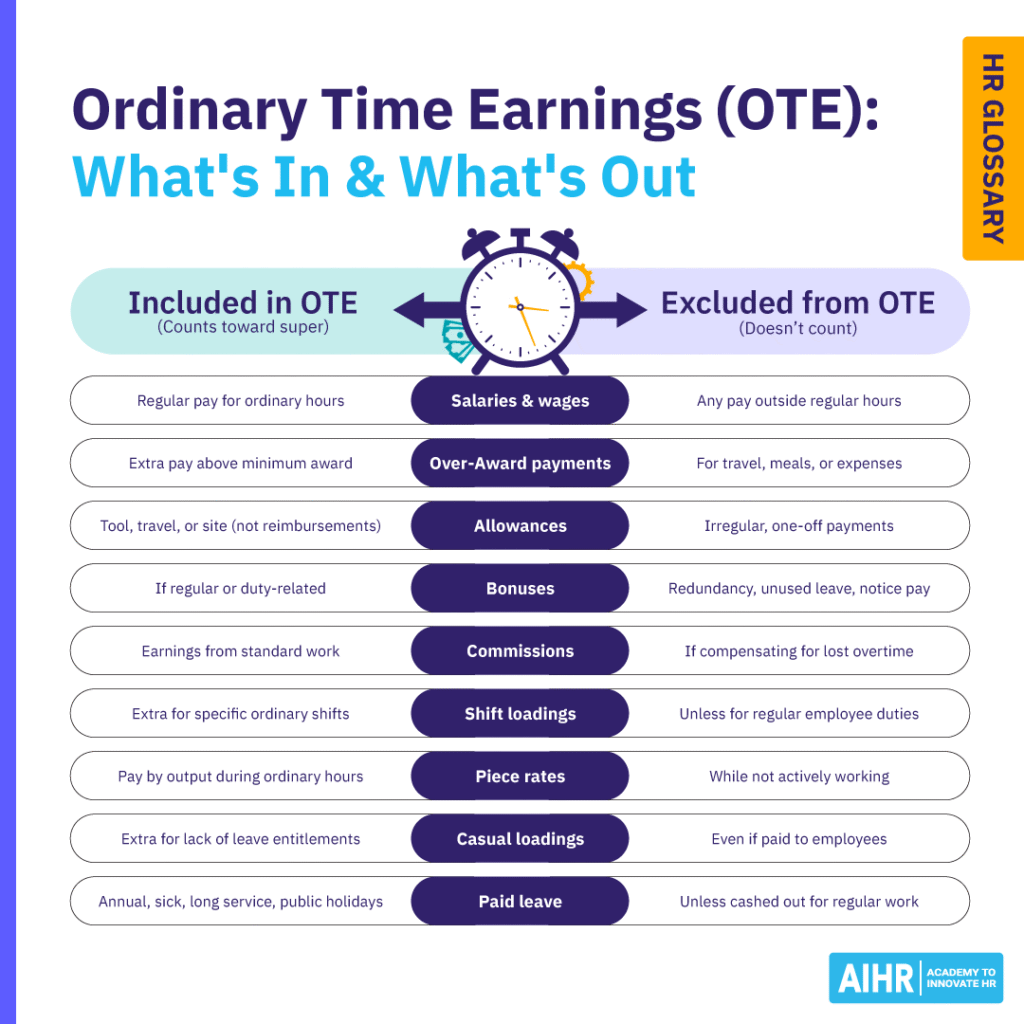

What is included in ordinary time earnings?

According to the ATO, the following payments are included in OTE for calculating superannuation guarantee contributions:

- Salaries and wages: Regular pay for performing duties during ordinary hours.

- Over-award payments: Extra payments on top of the minimum award wage for ordinary hours.

- Allowances: Tool, travel, or site allowances paid during regular work hours (excluding reimbursements).

- Bonuses: If they’re performance-based or part of regular work duties (not discretionary or irregular).

- Commissions: Earnings linked to sales or outcomes achieved during standard hours.

- Shift loadings: Extra amounts paid for working specific shifts during ordinary hours.

- Piece rates: Pay based on output during normal working hours.

- Casual loading: Extra pay given to casual workers who do not receive benefits like leave.

- Paid leave: Including annual leave, sick leave, long service leave, and public holidays.

What is excluded from ordinary time earnings?

The ATO also provides guidance on what is excluded from ordinary time earnings. Excluding these from your OTE calculations ensures your superannuation payments are compliant and accurate. These include:

- Overtime payments: Any pay for work outside ordinary hours, including penalty rates.

- Reimbursements: For travel, meals, or work-related expenses.

- Discretionary bonuses: Irregular or one-off bonuses not linked to an employee’s usual duties.

- Termination payments: Including redundancy payouts, unused leave, and payment in lieu of notice.

- Leave loading: When it’s paid to compensate for lost overtime during annual leave.

- Director’s fees: Unless paid to an employee for ordinary duties (in which case it may be included).

- Workers’ compensation payments: While the employee is not actively working.

- Dividends and trust distributions: Even if paid to employees or contractors.

- Non-monetary incentives: These can include a car or accommodation, unless converted to cash and paid for ordinary hours.

Develop your skills in super and pay compliance

Accurately handling Ordinary Time Earnings (OTE) is key to meeting Australia’s superannuation requirements and avoiding underpayment risks.

In AIHR’s Compensation & Benefits Certificate Program, you’ll learn how to manage payroll components like OTE, leave loading, and allowances, and how to build a compliant total rewards strategy that supports both business goals and employee trust.

How is OTE calculated?

Here’s a simple step-by-step guide you can use to calculate OTE and determine an employee’s superannuation guarantee contributions:

Step 1: Identify the employee’s ordinary work hours. Check the employee’s contract or relevant award. For full-time employees, this is typically 38 hours per week.

Step 2: List all earnings for ordinary hours. Include all earnings related to the employee’s ordinary duties, like salary, allowances, commissions, paid leave, shift loadings, and bonuses for ordinary performance.

Step 3: Exclude non-OTE payments. Remove non-countable amounts, like overtime, reimbursements, termination payments, or discretionary bonuses.

Step 4: Add up the eligible payments. The total of the included earnings becomes the employee’s OTE.

Step 5: Apply the superannuation guarantee rate. Multiply the total OTE by the current Superannuation Guarantee (SG) rate. This rate can increase each tax year, so it’s important to check current rates.

Calculation example

Employee details

- Weekly salary: $1,500

- Sales commission (ordinary hours): $300

- Travel allowance (ordinary hours): $100

- Overtime payment: $200

Calculation

Include:

- Salary: $1,500

- Commission: $300

- Allowance: $100

Exclude:

- Overtime: $200

Total OTE = $1,500 + $300 + $100 = $1,900

Superannuation = $1,900 × 11.5% = $218.50

As such, the employer must contribute $218.50 to the employee’s super fund for that week.

HR considerations for managing OTE

While payroll may handle the numbers, it’s HR’s role to ensure employment structures, contracts, and operational processes support accurate OTE calculations. The following actions can help prevent compliance errors and ensure super obligations are met across the workforce:

Clarify what counts as OTE

HR should ensure contracts, policies, and payroll systems clearly define which earnings count toward OTE. If you aren’t sure, regular training and access to ATO guidelines can prevent misclassification and underpayment of superannuation.

HR tip

Incorporate a step in your onboarding process to verify how each new hire’s pay components will be treated under OTE to ensure alignment among HR, payroll, and the employee from day one.

Watch for changes in role or pay structure

HR must reassess OTE payments when an employee’s role, hours, or pay change (e.g., moving from casual to permanent or taking on shift work). Remember, overlooking these changes can lead to super calculation errors.

Coordinate with finance and payroll

Collaboration between HR, payroll, and finance is critical. It’s HR’s role to ensure accurate employee records, job classifications, and allowances are shared with payroll for correct super calculation, so stay on top of each employee’s details and share any changes in a timely manner with payroll and finance.

Ensure employment contracts align with OTE obligations

HR should regularly review employment agreements and awards to ensure they reflect current OTE definitions, because misaligned contracts can cause confusion over entitlements, especially with bonuses, allowances, and shift loadings.

Stay on top of ATO guidance

The ATO can update its rules or examples on what counts as OTE. HR should monitor changes and adjust internal practices and training accordingly.

Support transparency with employees

Employees often don’t understand why some pay components count toward super while others don’t. By explaining how OTE is calculated, HR can improve clarity and trust.

Audit and review payroll practices

Regular internal reviews or audits can ensure OTE is correctly applied across all employee types, especially in larger organizations with diverse roles and pay structures.

FAQ

Ordinary Time Earnings (OTE) refer to the amount an employee earns for their ordinary hours of work. It includes salary, commissions, shift loadings, paid leave, and certain allowances. OTE forms the basis for calculating superannuation contributions and is defined by the ATO, which also outlines what must be excluded, like overtime and termination payments.

Yes. Super contributions are generally only required on earnings for ordinary hours of work, not on overtime. However, other regular payments like commissions, paid leave, and shift loadings still count. It’s critical to assess each payment against ATO rules to avoid compliance issues.